how to pay late excise tax online

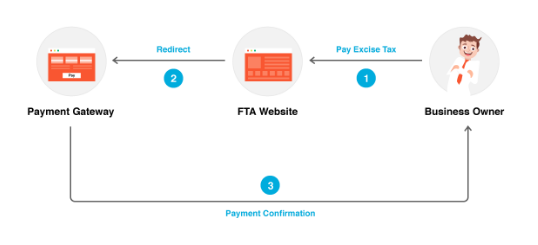

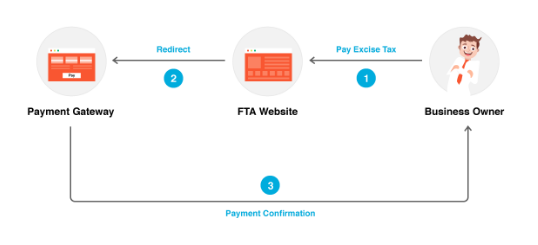

You can pay your excise tax through our online payment system. You must select the Form of Payment.

Motor Vehicle Excise Information Methuen Ma

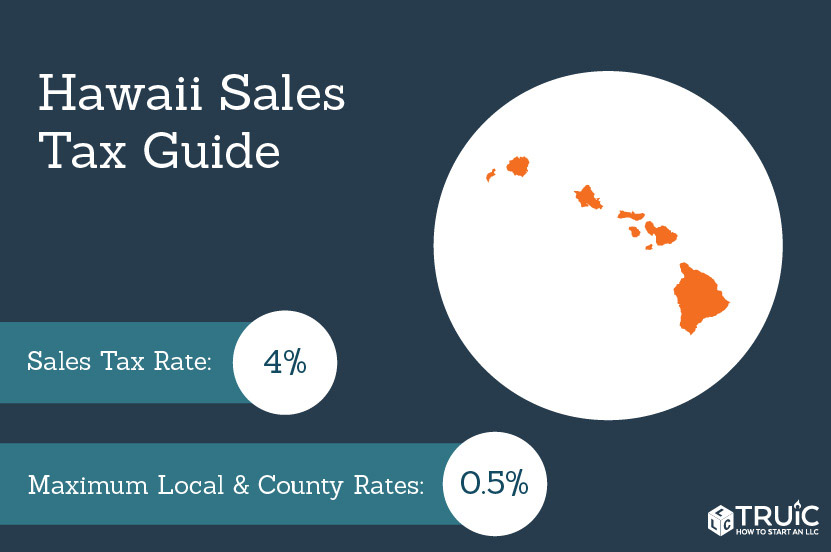

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use.

. We will then present bills found matching the options you provided. Hawaii does not have a sales tax. Request for Tax Information.

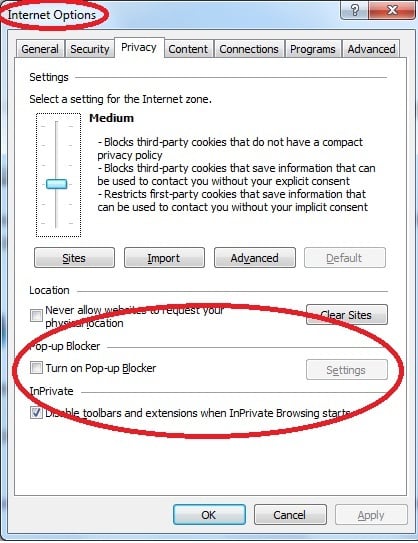

If you have to pay excise duty but dont have an excise licence PSP or movement permission youll need. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. Birth Marriage Death Certificates Dog Licenses.

The request must be made before the due date. The casual excise tax for a boat or boat and motor purchased as a package is 5 of purchase price with a maximum fee of 50000. The Department can waive late return penalties under certain circumstances.

If the demand is not answered within 14 days the collector. Simply make your selection through an IRS-approved software provider. With MassTaxConnect you can.

The tax collector must have received the payment. Item 2 - Form of Payment. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

Casual excise tax is charged upon the issuance of a title or proof of ownership for a boat or motor. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year.

Select the TTB form you want to file. In all situations payment of excise duty is due at the same time as lodgment of your excise return. Kelly Ryan Associates 3 Rosenfeld Dr.

Download permit application and informational packets. Municipal Lien Certificate Application. Massachusetts Property and Excise Taxes.

In addition interest will accrue on the overdue bill at an annual rate of 12 from the day after the due date. Quarterly Excise Tax Payment Procedures. Motor Vehicle Excise Tax.

The purpose of the TreasurerCollectors Office is to provide secure and accurate collection of all taxes and committed bills to us by the Assessors. If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 30 dollars. Once you enter your NAME please CLICK one of the options below to continue entering specific information.

Instead we have the GET which is assessed on all business activities. For EFTPS deposits to be on time you must initiate the transaction at least 1 day before the date the deposit is. You can always make a tax payment by calling our voice response system at 18005553453.

Where do you pay late Motor Vehicle Excise taxes. File TTB form on Paygov. PAY Delinquent Excise Tax and Parking Tickets.

Current Fiscal Year Tax Rate. You must deposit all depository taxes such as excise tax employment tax or corporate income tax by electronic funds transfer. Select the relevant challan ie.

A motor vehicle excise is due 30 days from the day its issued. Depending on the circumstances the Department may grant extensions for filing an excise tax return. The casual excise tax for a motor purchased alone is 6 with no maximum.

This information will lead you to The State. Check the status of your refund. If you mail your payment and return separately include Form OR-20-V Oregon Corporation.

Create account on Paygov. Send DOR a secure e-message. There is no statute of limitations for motor vehicle excise bills.

You must file an excise tax return for every excise tax period even if your tax liability is 000 unless you are a qualifying winery. You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis when you lodge your excise return. View or Pay Tax bills Excise Tax Water Sewer Bills.

If you are not sure which form you need please visit Business Central to check your filing responsibilities. Massachusetts Motor Vehicle Excise Tax Information. Visit their website here.

Get tax due dates. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. Once completed click the NEXT button within the option you choose.

They also have multiple locations you can pay including. City Clerks Office. Not just mailed postmarked on or before the due date.

Your tax payment is due regardless of this Web sites availability. Call our Contact Center at 617 887-6367 or 800 392-6089. File register abate and much more.

Schedule for semi-monthly quarterly and FAET filers. Excise tax return extensions. Submit the form and payment if required.

Please select one of the options below. You can pay tax penalties and interest using Revenue Online. Be sure to submit your filings and payments on time.

You are personally liable for the excise until the it is paid off. You need to enter your last name and license plate number to find your bill. Get excise tax rates.

Fill out the form you need to file. Select from commodity type and product. Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total.

File a permit application to receive approval to operate a TTB-regulated business. We will persevere in treating all taxpayers with equity and take all necessary steps allowable by law to collect on all past due accounts. Go to our online system.

Pay Taxes Online or click here on the tab e-pay taxes provided on the said website. Welcome to the Treasurer Collectors Department. Hopedale MA 01747 508-473-9660.

You can always make a tax payment by calling our voice response system at 18005553453. Form 720 Quarterly Federal Excise Tax Return is available for optional electronic filing. Excise taxes are taxes that are imposed on various goods services and activities.

Such taxes may be imposed on the manufacturer retailer or consumer depending on the specific tax.

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

Excise Tax Return Filing And Payment Zoho Books

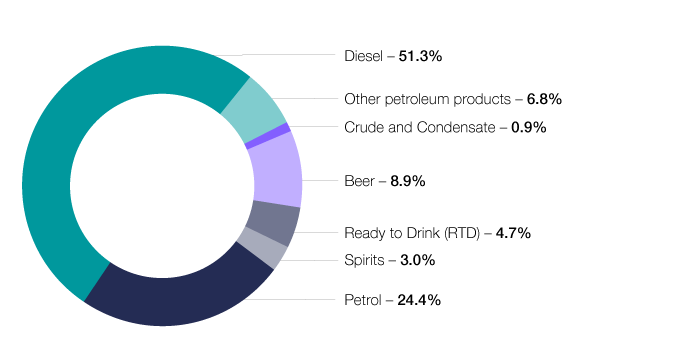

Excise And Fuel Scheme Statistics Australian Taxation Office

50 Off Your Form 2290 Annual Renewal Fee Renew Form Filing

Outstanding Excise Tax Bills Due Before May 10 2022 To Avoid Late Fees City Of Taunton Ma

Pdf Impact Of Excise Tax On The South African Economy A Dynamic Cge Approach

Excise Tax Deregistration How To Do Excise Tax Excise De Registration In The Uae

A Guide To New Mexico S Tax System New Mexico Voices For Children

Corporate Excise Tax Penalties Waived S Corporation Fiscal Year Corporate

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Online Bill Payments City Of Revere Massachusetts

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Hawaii General Excise Tax Small Business Guide Truic

Distilled Spirits Excise Tax Rates Around The Globe Five X 5 Solutions